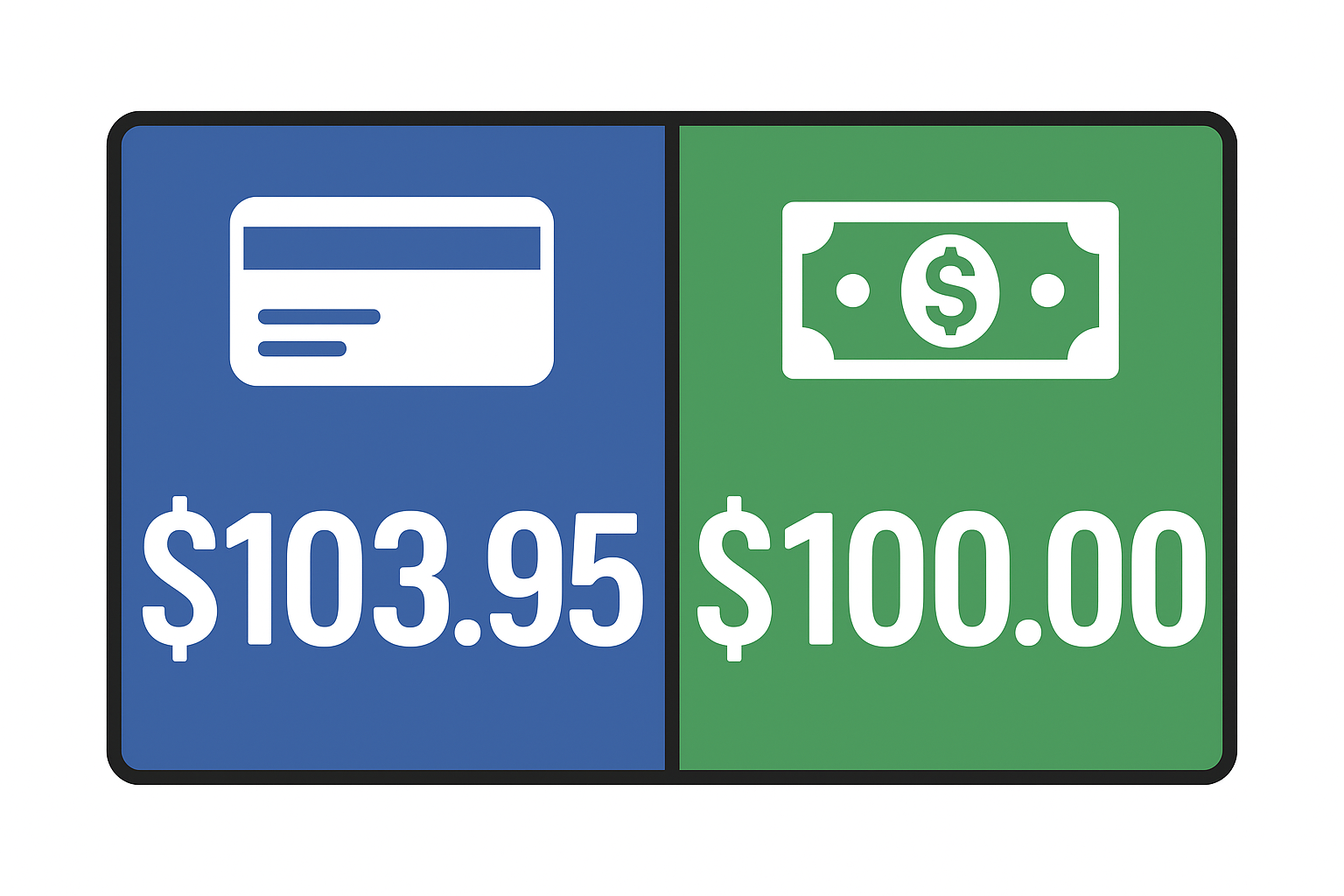

Dual Pricing

Dual Pricing enables merchants to "zero out" credit card processing costs. With Dual Pricing, a merchant simply displays a cash and card price, ensuring the card price covers the transaction costs.

Dual Pricing Display Example

- Cash Price: $100.00

- Card Price: $103.95

Merchant Post Customer Notice Signs at the Entrance and Point of Sale:

Items Display Both Card and Cash Price:

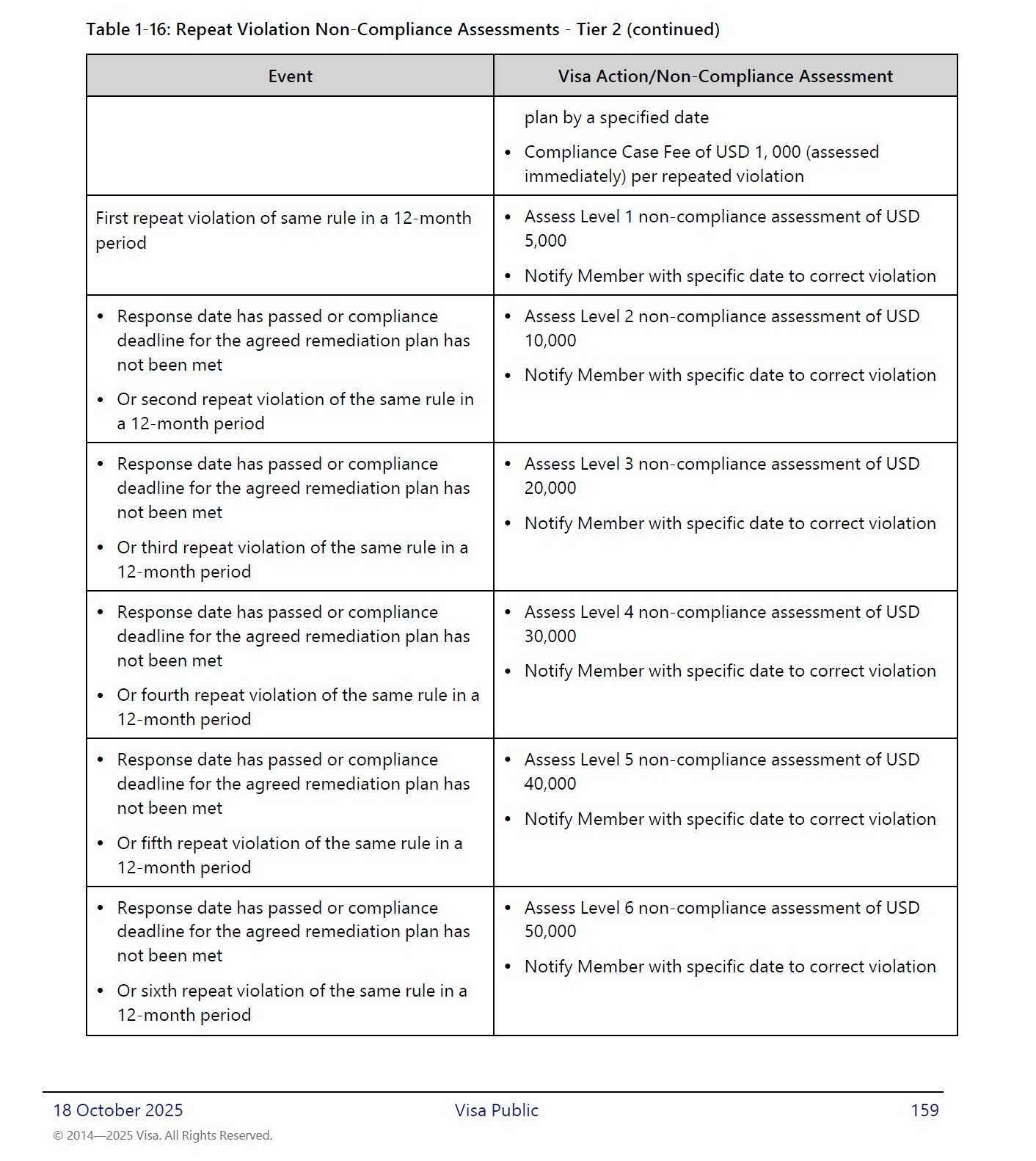

Visa Compliance

Dual Pricing has grown in popularity because traditional surcharging and minimum-purchase programs (e.g., a $10 credit-card minimum) cannot be applied to debit card transactions. Dual Pricing also ensures compliance with not surcharging above the actual “cost of acceptance” and surcharge registration requirements.

Compliance References

Visa Non-Compliance Fines

When implementing Dual Pricing — it’s essential to be fully compliant from day one! Visa conducts in-store audits and can issue non-compliance fines starting at $1,000 for a first violation. Additionally, any violation remains associated with the store location — regardless of ownership change or getting a new MID account from a different processor.